The native token of the Oasys ecosystem, OAS plays a crucial role with a diverse range of utilities, staking opportunities, and governance functions. This article will explore the various aspects of OAS and its significance within the Oasys network. The applications of OAS tokens differ from the perspective of users, developers, validators and delegators. Understanding the subtle differences and how OAS underpins the broader economy of Oasys is the first step in understanding the extensive ecosystem and the coming developments that await Oasys and its native token.

What is the OAS Token?

The OAS token is integral to the Oasys ecosystem, functioning as its core currency. For developers, understanding the utility of the OAS token is key, especially in how it relates to transactional operations and ecosystem participation.

Gas Fees

Within the Oasys architecture, actions that require transactional finality, such as rolling up transactions from a Verse-Layer to the Hub-Layer, employing a Bridge contract, or executing contracts on the Hub Layer, necessitate the payment of gas fees. Verse Builders are responsible for these costs, and with the expansion of the ecosystem—characterised by an increase in Verse-Layers and transaction volume—there’s an expected incremental rise in gas fees. The architecture, however, is designed to ensure that this increase is measured, allowing Verse Builders to scale their operations without disproportionate cost increases adversely affecting their growth.

Verse Building

Developers looking to contribute to the Oasys ecosystem by creating new Verses must make a substantial commitment in the form of OAS token deposits—exceeding 1 million OAS—when establishing a Verse contract. This deposit is a strategic move to promote the ecosystem’s integrity, deterring the development of fraudulent Verses and securing the developers’ long-term investment and participation in the ecosystem.

Payments

OAS tokens also serve a crucial role in facilitating transactions within the ecosystem, particularly for in-game micropayments. This is similar to ETH’s role in the Ethereum ecosystem, where it’s the primary medium for transactions. The versatility of OAS tokens in handling a multitude of micropayment transactions both within and beyond game environments underscores their importance as the key currency across the Oasys ecosystem.

Decentralised Governance

In addition to the above roles, OAS tokens will allow holders to participate in the decentralised governance of Oasys at the later stage of decentralising Oasys and transitioning it to a DAO. This process will see OAS holders voting on key proposals, which could range from altering inflation rates via staking mechanisms, deciding on treasury allocations, to choosing which contracts to build on the Hub-Layer. This element of governance will place a significant portion of the ecosystem’s direction and evolution in the hands of its token holders, embodying the principles of a decentralised community-driven environment.

Staking Rewards

Finally, OAS tokens offer staking rewards as an incentive for long-term holding and ecosystem support. Users staking 10 million OAS or more through a validator contract can become validators themselves. This process provides stakers with rewards and plays a critical role in securing and maintaining the network’s integrity. Through staking on Oasys Hub, users can contribute to the ecosystem’s stability while earning rewards, aligning their interests with the overall health and growth of the Oasys ecosystem.

Exploring Oasys’ Double-Layer Architecture

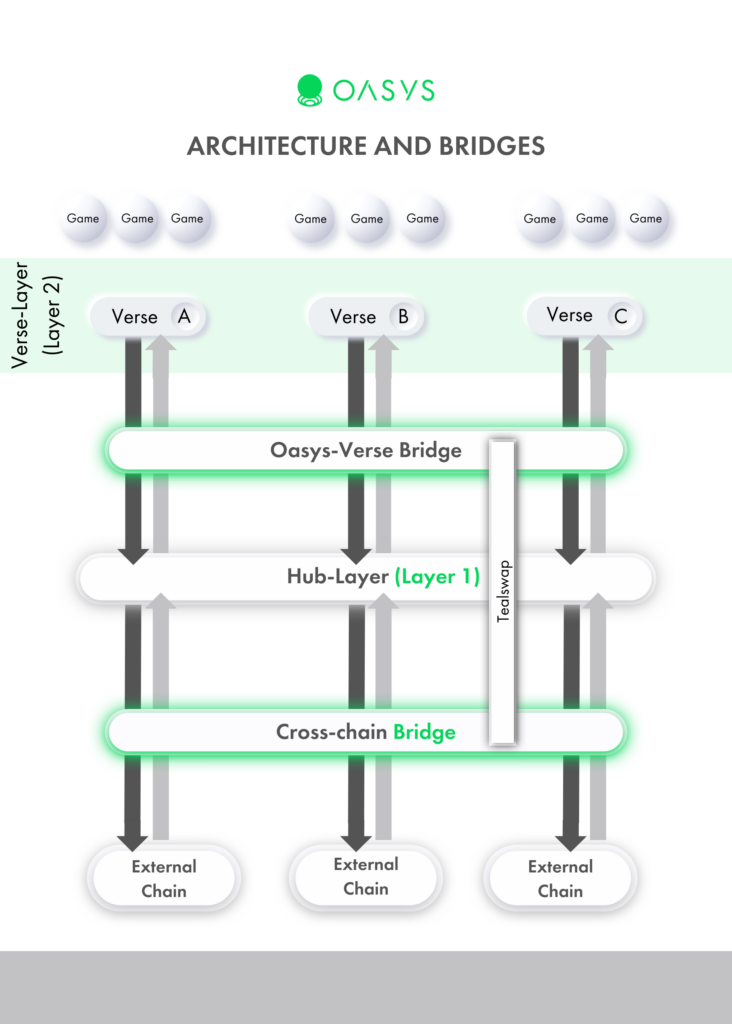

In the Oasys ecosystem, the token economy is devised to support its dual-layer architecture, consisting of the Hub-Layer (L1) and various Verse-Layers (L2). This structure is designed to overcome the limitations of a single-token system by introducing OAS tokens for the Hub-Layer, with individual Verse and Game/dApp Tokens to foster a versatile and scalable gaming environment. As the ecosystem matures, it adapts to host an array of Verses, each with unique economic models, to cater to diverse gaming and Dapp communities. Therefore, the token system in Oasys plays a crucial role in maintaining flexibility and encouraging innovation within the network.

The Oasys architecture includes a multi-faceted bridge system, integral for connecting the Hub and Verse-Layer, and facilitating interactions with external chains.

Tealswap enhances the Oasys ecosystem by managing the user interface and experience for asset transfers. It utilises two types of bridges: the Oasys-Verse L1<>L2 Bridge operated by Tealswap, and the cBridge (Cross-chain Bridge), handled by Celer for external transfers. This setup allows Tealswap to streamline the process of moving assets both within and outside the Oasys network.

The Oasys-Verse Bridge is the internal bridge, connecting the Oasys Hub (Layer 1) with various Verse-Layers (Layer 2). This bridge supports the transfer of fungible tokens, allowing users to move assets between the Hub and multiple Verses, including TCG Verse, MCH Verse, HOME Verse, Chain Verse, and Saakuru Verse. As we continue to expand the Oasys ecosystem and add new Verses, this will further extend the bridge’s reach.

For interactions beyond the Oasys network, Tealswap uses cBridge, an efficient solution for transferring assets to and from external blockchains such as Ethereum and Polygon. By integrating cBridge, Tealswap opens up cross-chain functionality, enabling the exchange of tokens between Oasys’s mainnet and partnered networks. This integration reflects a commitment to interoperability and user convenience, offering a seamless bridging experience for a broad range of assets within the decentralised finance landscape.

A unified UI, such as the one provided by Tealswap, simplifies user interaction with these bridges, consolidating them into a single access point. All bridges within the Oasys network are free. Only using Celer’s cBridge incurs a fee but ensures rapid transfers, demonstrating Oasys’s commitment to providing versatile and user-friendly bridging solutions for its community.

Oasys prioritises security in bridge operations, employing measures to protect against hacking without the need for centralised liquidity pools. The security-first approach benefits developers by providing a dependable infrastructure for deploying secure, scalable applications.

The confirmation time for state commitments in the Oasys network has been optimised for efficiency. The standard seven-day challenge window for commitments can be bypassed by instant verification from validators, enhancing user experience by reducing wait times for transactions.

Utility and Outlook of OAS Tokens

In the Oasys ecosystem, the OAS token assumes a central role, serving as the foundational currency that facilitates utility across the network’s L1 and L2 layers and providing holders with a range of utilities, staking possibilities, and governance privileges. Furthermore, OAS token holds utility within decentralised applications, partner chains and games, and smart contracts.

As Oasys’ adoption expands, the potential for OAS to become a preferred payment method among brands could lead to broader recognition and integration within the crypto economy. This aligns with Oasys’s vision of a multi-token economy where decentralisation and governance converge, promoting a robust and collaborative environment. The OAS token’s integration within the Oasys and Tealswap infrastructure underscores its essential role in driving the network’s growth and facilitating seamless asset transfer between the Hub and Verse-Layers and external blockchains. This cohesive token strategy ensures that the Oasys ecosystem remains adaptable, scalable, and primed for future expansion.

Learn more about building on Oasys and make your game Web3-ready with a blockchain optimised for gaming.

Learn more about Oasys:

Website: https://www.oasys.games/

Twitter: https://twitter.com/oasys_games

Discord: http://discord.gg/oasysgames

Telegram: https://t.me/oasysen